What Does an Accountant Do? Responsibilities, Skills & Trends

May 28th, 2024

You can earn your degree at your own pace—in 18 to 36 months—without sacrificing academic quality and rigor. Access lifelong career benefits and join a global community of over 44,000 alumni with an AACSB-accredited online MBA from UNC-Chapel Hill. The best way to transition into accounting is to find a master’s in accounting program specifically geared toward those without experience in the field. For example, UMass–Amherst offers a “transition track” designed specifically for students with non-accounting backgrounds. While individuals may have to take additional classes or bootcamp-style preparation courses, you can be well on your way to a career in the field in as soon as a few months.

Managerial Accounting

It isn’t always glamorous, though, and certainly isn’t a role suited to everyone. That depends on the company you work for, the agreement you have with them, and the workload you are given. Accountants generally earn a decent wage, with salaries varying depending on the location, job type, and experience. In 2023, the median annual wage for an accountant in the U.S. was $79,880, versus $48,060 for all occupations.

- Professionals in this field need to be able to use advanced accounting software and other computer-based tools to work effectively.

- This module is intended for students majoring in accounting and those who have a keen interest in gaining an understanding of elementary financial accounting.

- In short, although accounting is sometimes overlooked, it is absolutely critical for the smooth functioning of modern finance.

- This module looks to deconstruct what accounting and regulation is, and the role of international standard setters and politics in standard setting.

- Both accountants and financial analysts require a strong foundation in analytical skills, but the specific competencies needed for each role can differ.

- If the entries aren’t balanced, the accountant knows there must be a mistake somewhere in the general ledger.

Management Accountant

You don’t want to be in a situation where you have to pay more income tax than is normally required by the Internal Revenue Service (IRS). The Securities and Exchange Commission has an entire financial reporting manual outlining the reporting requirements of public companies. Financial accounts have two different sets of rules they can choose to follow. The first, the accrual basis method of accounting, has been discussed above.

Latest Finance Jobs

- The module commences with an introduction to double-entry booking keeping and accounting equations that govern the recording of business transactions.

- In accounting, automation and artificial intelligence (AI) have streamlined many routine tasks, such as data entry and reconciliation.

- A degree or license can still be helpful In this field, even in 2024, especially in certain highly regulated sectors.

- Accountants need a mix of technical and soft skills, which helps them stay updated on new trends to make the most of accounting technology.

- This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

If your business can afford to hire an accountant, doing so could save you time and potentially even tax dollars. We believe everyone should be able to make financial decisions with confidence. Analyze financial data to determine if crimes such as embezzlement or fraud have been committed. As a CPA, “you definitely earn more money” than an accountant without the credential, Chatterton said, noting it can add up to hundreds of thousands of dollars over the course of your career. Some move into business administration or corporate finance, where they may serve as controllers, treasurers, financial vice presidents, chief financial officers or corporation presidents.

This Institute was established in 1949 under the Chartered Accountants Act, 1949 for the regulation of the profession of chartered accountants in India. Whereas you might only periodically consult your accountant, a bookkeeper touches https://gromrady.org.ua/ru/2022/02/obzor-birzhi-exmo/ base more frequently and handles daily accounting tasks. Regardless of who you hire, knowing basic accounting principles can help you understand your business better and have more productive conversations with your financial team.

Questions About Accounting Careers

Jasmine Suarez is a senior editor at Fortune Recommends, where she was hired to build and launch the department in 2022. Before joining Fortune, she was a senior editor at Business Insider, where she led various verticals on the personal finance team. In the past, she’s worked for Red Ventures, Adweek, McGraw-Hill, Pearson, and more. Preston Fore is a staff writer at Fortune Recommends, covering education and its intersection with business, technology, and beyond. Preston graduated from the University of North Carolina at Chapel Hill, where he studied journalism and global studies. Accountants tend to have a detail-oriented, analytical outlook, and they should enjoy working with numbers.

We’ll explore some of the basic tasks of accountants, as well as the different types of accountants and the skills they require. Then we’ll look at current accounting trends to see how new technologies have influenced the accounting process. Each designation has various requirements, including past education and career experience. Additionally, these certifications have continuing education requirements that must be met every few years. An accountant must meet specific educational requirements and pass a certification exam to become a Certified Public Accountant (CPA). Retaining CPA status also requires meeting continuing education credit guidelines, which vary between states.

For one thing, the cost of hiring someone like this can be a substantial burden on your business’s finances. You can outsource your accounting work to outside professionals who specialize in bookkeeping http://ankerch.crimea.ua/page/9/ and tax preparation. Outsourcing can offer many advantages because it allows you to take advantage of specialized skill sets that may not be available when hiring someone in-house.

You’ll need to earn a bachelor’s degree for most accounting careers—generally in accounting, finance, economics, or your school’s equivalent. You can often get an entry-level job in accounting out http://btet.ru/ka/europe/nado-li-raspechatyvat-elektronnyi-bilet-na-samolet-chto-takoe-elektronnyi-bilet/ of college, but many higher-level (and higher-paying) accounting jobs require a CPA license. A certified public accountant, or CPA, deals with public financial documents such as tax filings.

Posted in Bookkeeping | Comments Off on What Does an Accountant Do? Responsibilities, Skills & Trends

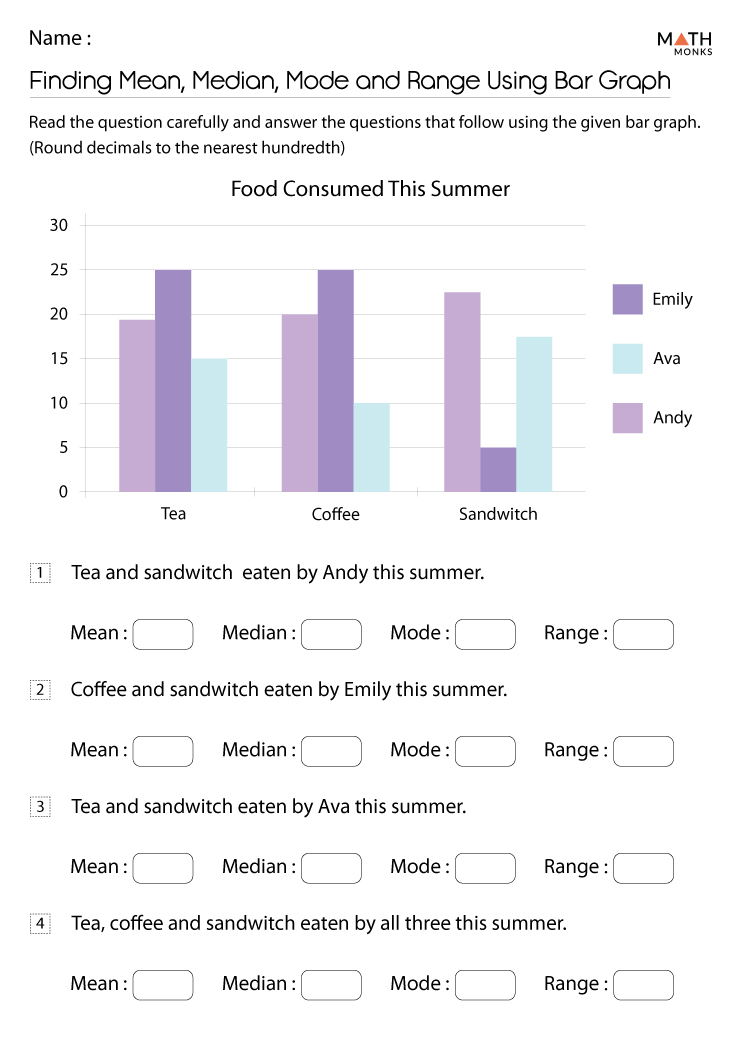

Mean, Median and Mode Definition & Formula with Examples

April 1st, 2024

The location of the median and the value of the median are not the same. The upper case letter \(M\) is often used to represent the median. The next example illustrates the location of the median and the value of the median.

- This is partly true, but there are also some much higher scores.

- Range (in statistics) is the difference between the maximum and minimum values of the set.

- A typical example would be the case where nearly every person in a given population lives on about two dollars a day, but there is a small elite with incomes in the millions.

- You can use the Mathway widget below to practice finding the median.

Differences between Mean, Median and Mode

Perfect for homework, in-class activities, or math revision. The decision between mean and median only really matters if the data are skewed. If the data are symmetric, then the mean and median are going what is range mode median and mean to be approximately equal, and the distinction between them is irrelevant. The median is a better measure of the “center” than the mean because 49 of the values are 30,000 and one is 5,000,000.

Formula Review

Again, it wouldn’t hurt if you ask advice from your teacher on how many decimals to round off as this part of the solution may be open to different interpretations. It is apparent that no value is repeated more often than the other. It just happens that the two center values are the same, therefore the average of two equal numbers will equal the same number.

Practise mean, median, mode and range

So, they are the modes (and we can conclude that this set of data is bimodal). The letter “M” is commonly used to represent the median of a dataset, whether it’s for a population or a sample. This notation simplifies the representation of statistical concepts and calculations, making it easier to understand and apply in various contexts. Therefore, in Indian statistical practice, “M” is widely accepted and understood as the symbol for the median. The three measures of central tendency provide different ways of summarizing and describing a set of data. In other words, they can help you to gain a more complete understanding of the data’s distribution.

The numerical average can mislead by suggesting that the average (in this case, we mean “typical”) person earns a few tens of thousands per year. This is an interesting example because the elements in the set now contain zeroes, a positive, and negative numbers. However, the methods that are used to solve for the mean, median, mode, and range do not change. To solve for the median, let’s arrange the list in increasing order and then pick the center value.

Clearly, the middle value is 6, so you can conclude that the median of the data set is equal to 6. To determine the median of numbers in the data set, simply find the middle value. To determine the mean of the data set, divide the total sum by the total amount of numbers. Furthermore, the range of a set of data is the difference between the highest and lowest values. In Example 8.3, we created a frequency distribution of the number of siblings of conflict resolution class attendees. Mean, Median, and Mode of any given data set is calculated using the suitable formulas which are discussed above in the articles.

Statistical software will easily calculate the mean, the median, and the mode. Some graphing calculators can also make these calculations. In the real world, people make these calculations using software.

The mode is the only average that can have no value, one value or more than one value. If there are two middle numbers, the median is the mean of those two numbers. If you had forgotten to divide by 5, then the answer would be 265, which is incorrect. A median value would be better to use if the supermarket didn’t want figures to be affected by unusually higher sales in December, for example.

Posted in Bookkeeping | Comments Off on Mean, Median and Mode Definition & Formula with Examples

W-8BEN: When to Use It and Other Types of W-8 Tax Forms

March 22nd, 2024

In lieu of the certifications contained in Parts IV through XXVIII of Form W-8BEN-E, in certain cases you may provide an alternate certification to a withholding agent. An FFI in a Model 2 IGA jurisdiction that has entered into an FFI agreement with respect to a branch is a participating FFI but may be referred to as a reporting Model 2 FFI. If, on the other hand, you have more income withheld than you should, you will receive a refund after you file your annual income tax return. Receiving a refund isn’t necessarily a good thing—it represents money you could have used throughout the year to pay your bills or invest for your future financial well-being. A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee’s paycheck and transmits to the IRS on their behalf.

If you do not provide this form, the withholding agent may have to withhold at the 30% rate (under chapters 3 and 4), backup withholding rate, or the rate applicable under section 1446. If you receive more than one type of income from a single withholding agent for which you claim different benefits, the withholding agent may, at its option, require you to submit a Form W-8BEN for each different type of income. Generally, a separate Form W-8BEN must be given to each withholding agent.

Everything You Need to Know About W8 Forms

Crucially, ECI is not subject to the same 30% withholding that applies to interest, rents, and other nonbusiness income. Instead, after subtracting applicable deductions, it is taxed at the graduated rate that U.S. citizens and resident aliens pay. If your work is covered by a U.S. treaty, it would be taxed at the lowest rate under that treaty. Form W-8BEN is used by foreign individuals who receive nonbusiness income in the U.S., whereas W-8BEN-E is used by foreign entities who receive this type of income. The version of the form used is determined by both whether or not the filer is an individual or a business and the nature of the income the filer received.

A transfer is a sale, exchange, or other disposition of a partnership interest, and includes a distribution from a partnership to a partner, as well as a transfer treated as a sale or exchange under section 707(a)(2)(B). A participating payee means any person that accepts a payment card as payment or accepts payment from a third party settlement organization in settlement of a third party network transaction for purposes of section 6050W. Ensuring that the right amount of money is withheld from each paycheck to pay federal income taxes is important.

Form W-8IMY

Generally, a payment to a U.S. branch of a foreign person is a payment to a foreign person. Foreign partnerships, foreign simple trusts, and foreign grantor trusts are not the beneficial owners of income paid to the partnership or trust. The beneficial owners of income paid to a foreign partnership are generally the partners in the partnership, provided that the partner is not itself a partnership, foreign simple or grantor trust, nominee or other agent. The beneficial owners of income paid to a foreign simple trust (that is, a foreign trust that is described in section 651(a)) are generally the beneficiaries of the trust, if the beneficiary is not a foreign partnership, foreign simple or grantor trust, nominee, or other agent. The beneficial owners of income paid to a foreign grantor trust (that is, a foreign trust to the extent that all or a portion of the income of the trust is treated as owned by the grantor or another person under sections 671 through 679) are the persons treated as the owners of the trust.

Generally, only a nonresident alien individual can use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a “saving clause” which preserves or “saves” the right of each country to tax its own residents as if no tax treaty existed. Exceptions specified in the saving clause may permit an exemption from tax to continue for certain types of income even after the recipient has otherwise become a U.S. resident alien for tax purposes.

What Is IRS Form W-8?

Generally, a separate Form W-8BEN-E must be given to each withholding agent. When subject to withholding of U.S. taxes, the single owner of a disregarded entity, NRA-classified what is a w8 account holder of a foreign financial institution (FFI), and the non-U.S. Transferor of an interest in a partnership for a connected gain are also required to file Form W-BEN.

- This form acts a proof of status that the company is conducting business within the US, however, it is primarily based in a foreign country.

- The last form on our list (Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting) is only used by intermediaries, flow-through entities, and certain U.S. branches.

- For chapter 4 purposes, a change in circumstances generally occurs when there is a change in a person’s chapter 4 status.

- But it’s used when the payee is an entity, such as a trust or corporation, rather than an individual.

Posted in Bookkeeping | Comments Off on W-8BEN: When to Use It and Other Types of W-8 Tax Forms

A closer look at the 11% dividend yield forecast for Phoenix Group shares The Motley Fool UK

March 13th, 2024

The primary types include cash dividends, stock dividends, and property dividends. Dividends represent a crucial aspect of shareholder returns and corporate financial strategy. They serve as a tangible reward for investors, reflecting a company’s profitability and stability. Understanding dividends is essential not only for https://www.bookstime.com/ investors seeking income but also for companies aiming to maintain investor confidence and market value.

What are Capital Asset Pricing Models (CAPM)?

- First, the board must decide what type and amount of distribution should be given to shareholders if any.

- This allocation reflects the company’s confidence in its financial health and future prospects.

- Quarterly is the most common frequency of payment, but a company can also choose to pay monthly, semi-annually, or annually.

- A dividend is a proportion of profit paid by a company to its shareholders.

- So, there’s some uncertainty in relation to future payouts here, in my view.

This preferential tax treatment is designed to encourage investment in corporate equities. Property dividends are less common and involve the distribution of non-monetary assets to shareholders. These assets can include physical goods, real estate, or even shares of a subsidiary company. For instance, a company might distribute shares of a subsidiary it owns as a property dividend.

Pros and Cons for Companies and Investors

Dividends are commonly distributed to shareholders quarterly, though some companies may pay dividends semi-annually. Payments can be received as cash or as reinvestment into shares of company stock. In some jurisdictions, tax credits or deductions are available to mitigate the impact of double taxation. For example, in Canada, the dividend tax credit allows individuals to reduce their tax liability on dividends received from Canadian corporations.

Declaration Date

Moreover, during economic contractions, these companies continue to pay high yields. Companies pay out their dividends in different ways depending on their business model QuickBooks or board of directors’ decision. You will not receive a dividend payment if you buy a stock after the ex-dividend date. On the other hand, all investors receive the exact yield for each share. Of course, big money players like Warren Buffett may buy $5 billion in Goldman Sachs with a 10% yield and warrants to acquire a few billion more at an even lower rate.

How Do Dividends Work?

In other words, investors will not see the liability account entries in the dividend payable account. Dividends can be accounted for using either accrual or cash flow methods depending on the company’s financial activity during a specific period. The accrual method considers regular payments made by the company (regardless of whether shareholders have received them or not). In contrast, cash flow accounting only considers actual dividend payments received by shareholders during the period under analysis.

Is this a risky stock?

A stock split occurs when a company splits its shares due to an inflated share price. For example, if the company is doing a 2-for-1 stock split, your total number of shares held will double while the share price is cut in half. Declaration date is the date that the board of directors declares the dividend to be paid to shareholders. It is the date that the company commits to the legal obligation of paying dividend. Hence, the company needs to make a proper journal entry for the declared dividend on this date.

- You need to make sure that your calculations are correct before moving on.

- To record the declaration, you’ll debit the retained earnings account — the company’s undistributed accumulated profits for the year or period of several years.

- The examples presented should demonstrate that there are many bargains out there if we seek them.

- In some jurisdictions, tax credits or deductions are available to mitigate the impact of double taxation.

- A real estate investment trust (REIT) owns or operates income-producing real estate.

- In general, if you own common or preferred stock of a dividend-paying company on its ex-dividend date, you will receive a dividend.

At the Board of Directors’ meeting, the dividend is officially ‘declared’. You might be the sole owner, director and worker in your limited company. This doesn’t mean that you have to discuss this with yourself in some kind of surreal, seat-swapping situation. You do need to officially record your dividend declaration as part of your business records as ‘meeting notes’. The what type of account is dividends value of the dividend is usually a set amount, per share of stock owned. So by definition, whoever owns the most stock, earns the most dividends.

Posted in Bookkeeping | Comments Off on A closer look at the 11% dividend yield forecast for Phoenix Group shares The Motley Fool UK

Income Statement: Understanding its Components and Importance in Finance

January 12th, 2024

The applications vary slightly from program to program, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. No, all of our programs are 100 percent online, and available to participants regardless of their location.

- The heading of the income statement identifies the entity, presents the title of the income statement, and shows the period covered by the report.

- The gains and losses are recorded as the net change rather than the gross increase and decrease in owners’ equity.

- The main purpose of an income statement is to summarize a company’s financial performance over a certain period of time.

- One of the main sections of the income statement is revenue or sales, which directly influences several lines on the balance sheet.

- But once you learn how all the different line items interact, and what they mean for your company’s financial performance, you’ll be better able to troubleshoot, fine tune, and plan your day-to-day operations.

A quarterly or annual report, on the other hand, provides analysis from a higher level, which can help identify trends over the long term. Revenue realized through secondary, noncore business activities is often referred to as nonoperating, recurring revenue. To calculate interest charges, you need to know the focus of an income statement is on how much money the business owes to creditors, and what interest is being charged on that amount. You can use specialized accounting software to automatically tally the interest charges for the reporting period. Next, you would need to determine the gross profit generated during the reporting period.

A Real Example of an Income Statement

These are all expenses that go toward a loss-making sale of long-term assets, one-time or any other unusual costs, or expenses toward lawsuits. A business’s cost to continue operating and turning a profit is known as an expense. Some of these expenses may be written off on a tax return if they meet Internal Revenue Service (IRS) guidelines. Payment is usually accounted for in the period when sales are made, or services are delivered. Receipts are the cash received and are accounted for when the money is received.

In some cases, the values reported by Mr Trump were disputed in the New York civil case, which the real estate billionaire plans to appeal. Below is a breakdown of some of Mr Trump’s assets and sources of income, based on court filings and federal financial disclosures. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

MULTI-STEP INCOME STATEMENT EXAMPLE

The income statement can also help you make decisions about your spending and overall management of business operations. Income statements should be generated quarterly and annually to provide visibility throughout the year. Similarly, various expenses reported on an income statement also have corresponding entries on the balance sheet. For instance, when a company makes a purchase but doesn’t pay for it immediately, the expense will appear on the income statement and simultaneously add a liability on the balance sheet under the form of accounts payable. To provide deeper insights, profit margins are often broken down into gross, operating, and net margins.

In simple terms, the profit margin is the percentage of revenue that results in profit. This is calculated by dividing net income by total revenue, then multipying the result by 100 to get a percentage. High profit margins indicate that the company effectively controls its costs. Lower profit margins may suggest issues with cost management or could be a characteristic of the particular industry. Pre-tax income, also referred to as earnings before tax (EBT), indicates the financial performance of a company before accounting for income taxes.

Benefits of a multi-step income statement for small businesses

Income statements can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus. It provides insights into a company’s overall profitability and helps investors evaluate a company’s financial performance. An income statement is one of the most important financial statements for a company. Operating expenses totaling $37,000 were then deducted from the gross profit to arrive at the second level of profitability – operating profit which amounted to $6,000. Non-operating revenues are revenues that a company earns from activities that are not related to its primary business operations. This is the profit before any non-operating income and non-operating expenses are taken into account.

Posted in Bookkeeping | Comments Off on Income Statement: Understanding its Components and Importance in Finance

QuickBooks Online Pricing Guide 2024

November 27th, 2023

Learn more about the details of each additional QuickBooks fee below. Here’s a complete breakdown of what’s included with each QuickBooks Online pricing plan. For just $50, QuickBooks Live Bookkeeping will set you up with an hurdle rate vs internal rate of return irr expert for one session.

Tax Forms & Support

Zoho Books is a top choice for small and growing businesses. Zoho Books has a free plan, while QuickBooks does not, and both Zoho Books and QuickBooks offer a large range of features on their higher-priced plans. This plan is best for small businesses, whether an LLC run by just one individual or a simple partnership. It’ll help someone keep their accounting data in one place, although it doesn’t offer many bells and whistles that could be useful for a larger operation. It’s worth noting, however, that these prices are part of a special deal that gets you 50% off control your budgets using encumbrance accounting in oracle for the first three months.

Advanced

The custom price varies depending on the size of your business but should be somewhere between $200 and $600 per month. This plan is designed for freelancers who file a Schedule C IRS form to report their income as sole proprietor. Employees can also take breaks and add timesheet details on it. If they use their smartphones, the app can alert them if they ever forget to clock in or out of the office.

QuickBooks Payments: Starts at $30/mo.

- QBO is best for small businesses looking for easy-to-use, cloud-based accounting software and strong mobile apps.

- QuickBooks Online can be a more cost-efficient option for businesses with multiple users that don’t want to navigate the steep learning curve of QuickBooks Desktop.

- QuickBooks is a well-established accounting software that is widely used by businesses from a variety of industries.

- Still, QuickBooks Online offers an unbeatable range of features, packaged in a solid interface with good support.

- If you can’t decide between two programs, here’s how they stack up head-to-head to help you determine which version of QuickBooks is the best accounting solution for your business.

- For just $50, QuickBooks Live Bookkeeping will set you up with an expert for one session.

After that, the Simple Start tier goes back to the standard price, which is $35 per month, while the Advanced plan goes as high as $235 tax season when you’re self employed vs freelance per month. On top of that, you’ll have to forego the 30-day free trial to get access to these lower prices. You can order QuickBooks-compatible checks from Intuit at an additional cost. The available options range from basic voucher checks to secure premier voucher checks. Their kits are designed to work seamlessly with QuickBooks Online. So you don’t need to spend hours figuring out how to convert the data from your accounting software to your tax forms.

How Much Is QuickBooks Online?

You’ll be able to track bills, set up recurring billing, track expenses, record payments in multiple currencies, and scan bills to keep abreast of all the money your company is owed. The Essentials plan is a great fit for growing small businesses that have an increased number of suppliers, employees, and clients. Finally, you can start creating budgets and cash flow projections based on your client and supplier information. Similarly, you can create a client database and track overdue client payments to keep on top of who owes you what. Simple Starts includes all the features from the Self-employed Plan but adds a range of helpful additions covering everything from basic bookkeeping to budgeting. But you can save on costs for 3 months with their 50% off discount.

QuickBooks Solopreneur (formerly known as QuickBooks Self-Employed) costs $20/month or $120 for the first year. This software is best suited for freelancers, allowing them to track income and expenses, track mileage, estimate quarterly taxes, and run basic reports. Read our full QuickBooks Checking review for more information. QuickBooks Desktop also has a more dated and harder-to-navigate UI than QuickBooks Online.

Due in part to these reasons, QuickBooks is our pick for the best hospitality accounting software. QuickBooks Mac Plus — also known as QuickBooks for Mac — is locally-installed accounting software designed specifically for Mac users. QuickBooks Mac Plus has the usability of QBO matched with the advanced features and accounting of the other QuickBooks Desktop products. The software supports up to three users, although additional users incur an extra fee.

Enterprise is our best-in-class business management solution. Clarify complexity with efficient inventory management and integrated payroll and time tracking. Plus, with access for up to 40 users, Enterprise can scale with your business as it grows. Although QuickBooks Online is a great cloud-based accounting platform, it isn’t the only one. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews.

Posted in Bookkeeping | Comments Off on QuickBooks Online Pricing Guide 2024

Construction Accounting Dermody, Burke & Brown, CPAs, LLC

September 1st, 2023

We understand your construction company needs sound financial advice and rock-solid resources to help you navigate the ins and outs of your world. Receive financial tips, tax due dates and tax strategies right in your inbox from our accounting firm. The growth of your company depends on a detailed understanding of your cash flow. Our business experts can break down your expenses, handle client billing and invoicing, and tell you exactly where your money is going and how to make it work for you.

Tax Planning Guide

Our CPAs and accountants specialize in the Massachusetts tax code, meaning we’ll always be ready to save your construction firm money on your tax bill. Whether it’s paying an estimated quarterly tax or filing a year-end return, you can count on our team to maximize savings and handle the IRS, even when it comes to fighting audits. Shortly after you sign up, we’ll give you a call to learn more about your business and bookkeeping needs. On this call, we’ll connect your accounts to Bench, and gather any extra documentation we need to complete your books.

Boston Bookkeeping Services

When you’re looking for a construction industry accountant, DB&B delivers the project level accounting and analysis you need to reduce expenses and increase opportunities for growth. Industry workshops offer insights into the latest real estate accounting practices. Say goodbye to piles of paperwork and time-consuming manual tracking—we automate inputs directly from linked accounts. Get insights from one central dashboard so you can easily understand the health of your business and make strategic decisions.

Marcum LLP Unveils Critical Industry Trends in 2024 Construction Survey Amid Economic Uncertainty

- FOUNDATION’s General Ledger Module enables contractors to perform daily transactions and period-end procedures efficiently and get reports from a powerful and scalable database.

- For years, we’ve helped construction contractors overcome challenges and achieve more successful project bidding.

- Accurate accounting is critical to the continued success of small businesses in the construction industry, but trying to manage these functions can drain time and resources.

- With construction accounting from DB&B, you get more insights with a faster turnaround than in-house accounting without the cost of an employee.

- This feature saves you the time and effort of manually uploading documents.

Moreover, customization options allow businesses to tweak these templates to suit their construction bookkeeping services specific needs. This flexibility ensures that real estate businesses can generate reports that truly reflect their operations and financial health. Hard costs predominantly revolve around the tangible elements of a development project. These include expenses tied to the actual physical work, such as materials, labor, and machinery. Hard costs make up the lion’s share of a developer’s budget, needing meticulous tracking.

In the bustling city of Boston, Massachusetts, small business owners are often juggling numerous responsibilities from day-to-day. The pressure from handling intricate financial aspects like bookkeeping and tax compliance can be overwhelming. Bench Accounting understands this struggle, and that’s why we provide comprehensive online bookkeeping services specifically designed for Boston’s diverse businesses. We streamline your bookkeeping process, continuously staying updated on changes in laws that can impact your business, such as the Massachusetts Gross Receipts Tax.

- The whole system has bank integration so that you don’t have to waste time with time-consuming reconciliations.

- We understand there’s a lot to consider, from overall project costs to budgeting for materials, tools, equipment, labor and everything in between.

- With our accounting software, you get instant access to detailed, actionable reports that drive informed decision-making.

- We are here to help you streamline your accounting needs efficiently and effectively.

- Great bookkeeping for contractors is the foundation of all tax reduction planning, scalability & cash flow management.

- Whether it’s choosing the right insurance, hiring new employees, or branching out into new markets, Appletree can help.

As a https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects contractor, you need to know exactly where every dollar, hour, and quantity goes on your jobs. With the FOUNDATION Job Costing Module, you get Microsoft® SQL Server®-powered reporting, which means stress-free job costing across the date range you need. The Simmons University 398,000-square-foot project will be the new Living and Learning Center.

- Our bookkeepers reconcile your accounts, categorize your transactions, and make necessary adjustments to your books.

- Receive financial tips, tax due dates and tax strategies right in your inbox from our accounting firm.

- Advanced analytics and insights further refine their financial strategies.

- This flexibility ensures that real estate businesses can generate reports that truly reflect their operations and financial health.

- Whether you’re a remodeler, painter, flooring contractor or plumber, we’ll help you lower taxes & keep perfect financials.

- Say goodbye to piles of paperwork and time-consuming manual tracking—we automate inputs directly from linked accounts.

Having key accounts segregated simplifies the financial analysis of projects. Moreover, developers benefit from real estate accounting construction bookkeeping services that offer specialized expertise. In essence, good accounting practices drive the real estate development firm’s financial health.

Posted in Bookkeeping | Comments Off on Construction Accounting Dermody, Burke & Brown, CPAs, LLC

Guide to Predetermined Overhead Rate Formula

August 30th, 2023

Identifying and reducing costs to your own business by budgeting and making changes can maximize the amount of revenue you take in, affecting the success of your business in the long term. This information can help you make decisions about where to cut costs or how to allocate your resources more efficiently. The cost of your office rent would be considered overhead because it’s something you have to pay regardless of how many t-shirts you sell. A good rule of thumb is to ask yourself if the cost will be incurred regardless of how much product you’re making.

Overhead in the Movie Industry

- It would involve calculating a known cost (like Labor cost) and then applying an overhead rate (which was predetermined) to this to project an unknown cost (which is the overhead amount).

- The computation of the overhead cost per unit for all of the products is shown in Figure 6.4.

- Thus the organization gets a clear idea of the expenses allocated and the expected profits during the year.

- Suppose that X limited produces a product X and uses labor hours to assign the manufacturing overhead cost.

- Another way to view it is overhead costs are those production costs that are not categorized as direct materials or direct labor.

Nonetheless, it is still essential for businesses to reconcile the difference between the actual overhead and the estimated overhead at the end of their fiscal year. Suppose the estimated manufacturing overhead cost is $ 250,000 and the estimated labor hours is 2040. As you can see, calculating your predetermined overhead rate is a crucial first step in pricing your products correctly. By taking the time to estimate your overhead costs and calculate your predetermined overhead rate, you can ensure that your prices are CARES Act fair and accurate and that your profits aren’t getting eaten away by hidden costs. Hence, it is essential to use rates that determine how much of the overhead costs are applied to each unit of production output. This is why a predetermined overhead rate is computed to allocate the overhead costs to the production output in order to determine a cost for a product.

Pre-Determined Overhead Rate Examples

The predetermined rate is a calculation used to determine the estimated overhead costs for each Bookkeeping for Chiropractors job during a specific time period. Of course, management also has to price the product to cover the direct costs involved in the production, including direct labor, electricity, and raw materials. A company that excels at monitoring and improving its overhead rate can improve its bottom line or profitability. Direct costs are costs directly tied to a product or service that a company produces.

Setting pricing

In these situations, a direct cost (labor) has been replaced by an overhead cost (e.g., depreciation on equipment). Because of this decrease in reliance on labor and/or changes in the types of production complexity and predetermined overhead rate methods, the traditional method of overhead allocation becomes less effective in certain production environments. To account for these changes in technology and production, many organizations today have adopted an overhead allocation method known as activity-based costing (ABC). This chapter will explain the transition to ABC and provide a foundation in its mechanics.

Predetermined Overhead Rate (POHR): Formula and Calculation

- Job costing is commonly used by construction companies, where costs vary widely from job to job.

- Advertising Firms – Marketing and advertising costs may include rent, office supplies, computer software, utilities, internet services, and much more.

- A company that excels at monitoring and improving its overhead rate can improve its bottom line or profitability.

- The example shown above is known as the single predetermined overhead rate or plant-wide overhead rate.

The controller of the Gertrude Radio Company wants to develop a predetermined overhead rate, which she can use to apply overhead more quickly in each reporting period, thereby allowing for a faster closing process. A later analysis reveals that the actual amount that should have been assigned to inventory is $48,000, so the $2,000 difference is charged to the cost of goods sold. You can calculate this rate by dividing the estimated manufacturing overhead costs for the period by the estimated number of units within the allocation base. Therefore, in simple terms, the POHR formula can be said to be a metric for an estimated rate of the cost of manufacturing a product over a specific period of time. That is, a predetermined overhead rate includes the ratio of the estimated overhead costs for the year to the estimated level of activity for the year. Management analyzes the costs and selects the activity as the estimated activity base because it drives the overhead costs of the unit.

Posted in Bookkeeping | Comments Off on Guide to Predetermined Overhead Rate Formula

Bi-Weekly’ vs ”Semi-Monthly’: What’s the Difference?

May 30th, 2023

With bi-monthly pay, you’ll pay your employees twice a month on set days. While bi-monthly payments often come out to twice a week, there are actually slightly more than two weeks between payments semi monthly vs bi weekly on average. This then causes paydays to fall slightly over two weeks apart at times. You need to consider how many employees you have and whether those employees are hourly or salaried.

- When you add these parts together, you get an adverb that means occurring every two weeks or every other week.

- This article delves into the strengths and weaknesses of semi-monthly vs bi-weekly payroll.

- Employees are also in a position to anticipate how much amount can be received in every paycheck.

- From an administrative perspective, payroll processing requires time and resources.

Gone are the days when payroll tracking was done with a pen and paper. Technology brings us many new ways to automate this process and save time. Here is our list of the best payroll software for small businesses in 2023. Bi-weekly payroll is a payment schedule through which employees are paid every two weeks on a particular day of the week.

Payroll considerations

Pay practices, like all aspects of the employee experience, are an important part of your offer as an employer. How often you pay employees is much more than an administrative decision as it affects your ability to attract and retain great performers. Several factors come into play when choosing between semi-monthly vs bi-weekly payroll. Semi-monthly is a more common form of payment frequency accepted by companies and firms worldwide. If the state requires that the bi-weekly payment be paid in the right manner, it also states that the employee cannot be paid less than what his/her/their hourly salary demands.

- In the most practical terms, that means employees who are paid bi-weekly receive more paychecks than employees who are paid semi-monthly.

- We’ve also got a whole library of content on other confusing words and phrases you might see while learning the language.

- When it comes to managing your teen’s finances and helping them understand the world of work, explaining employers’ different pay schedules can be a significant stepping stone.

- Our services cover all aspects of your payroll process and payroll tax needs.

It is essential to know the various types of pay periods and how they affect your business and your employees — but it can be confusing. With bi-weekly payments, you’ll have two months where you receive three paychecks. You’ll always know which two days you’ll be paid for semi-monthly payments.

Want More Helpful Articles About Running a Business?

On the other hand, companies have a set date in the middle and end of the month for when they process payroll. The best payroll schedule depends on your personal preferences, whether you are a salaried or an hourly employee, your industry, your company’s policy, and more. The rule of thumb is to pick semi-monthly if you are a salaried employee and bi-weekly if you are an hourly employee. To make this as comprehensive as possible, we have provided answers to the most common questions about bi-weekly and bi-monthly pay schedules.

- Publications that occur twice per month and every other week also use the words ‘semi-monthly’ and ‘bi-weekly,’ respectively.

- If you use one of these providers, you will pay more per year to run biweekly as opposed to semimonthly payroll.

- The most common pay periods are weekly, biweekly, semi-monthly, and monthly.

- After considering the number of employees working and how many of them are salaried and hourly, the decision of running a semi-monthly payroll must be taken.

- To combat this, you could run semimonthly payroll for salaried employees and biweekly for hourly workers.

- It requires you to be familiar with many laws and regulations and think of your employees’ well-being too.

- Both are great, and the one you choose depends on your industry, company size, number and type of employees, and payday regulations in your region.

Biweekly paychecks will be be for less money, but employees will receive the two additional paychecks to make up the difference. If you’re paid hourly for your work, your paychecks will be more random, regardless of the payment schedule you receive. This is especially true in the case of semimonthly pay, as the number of days between paychecks can have a substantial impact on the amount you’re paid. Semi-monthly pay frequencies are a good option if you only have salaried employees. The frequency of a semi-monthly payment and the consistency of having set days also make it easier for your employees to budget for their personal expenses.

Payroll Schedule preferences

This is because there are 2 months where they receive 3 instead of 2 paychecks and 10 months where they receive 2 paychecks. Depending on several factors, employers choose to pay their employees biweekly, weekly, monthly, and semi-monthly. In this article, we’ll discuss the difference between bi-weekly and semi-monthly pay periods. Depending on the choice made between the two, the budget of a company is impacted.

Posted in Bookkeeping | Comments Off on Bi-Weekly’ vs ”Semi-Monthly’: What’s the Difference?

Burn Rate Calculator: Calculate Your Monthly Burn & Runway

April 17th, 2023

The burn rate is used to pinpoint when a company will be going into debt and is expressed as the company’s financial runway. As a small business owner, knowing your cash runway helps you identify areas where you can make adjustments to optimize cash flow and improve cash management. It recording transactions gives you a better understanding of your current financial situation and allows you to plan for upcoming expenses and investments.

Why is burn rate important for startups and businesses?

Salaries often account for a significant portion of a startup’s overall burn rate. Laying off employees is one of the most direct ways to cut people-related expenses and lower the burn rate. Investors track a startup’s burn rate when evaluating investment opportunities. A longer runway allows the company more time to achieve profitability or secure the next round of funding. Effectively managing burn rate is a delicate balance that founders must master to increase their chances of long-term success. This will give you the average monthly burn rate for your specified period.

- It’s up to each analyst to carefully assess the business plan and determine whether the burn rate is justified or troubling.

- Moreover, dependence on additional funding can make a company vulnerable to shifts in the market or economy, as it may struggle to secure financing during periods of financial instability.

- In addition, reducing costs can help a small business to better manage its cash flow, making it more resilient in the face of economic downturns and other challenges.

- Company X’s burn rate is $20,000/month for the first quarter of the year.

- A high burn rate is just a fact of life for many early-stage businesses.

- A lower burn multiple (e.g., under 2x) is generally seen as more favorable, indicating the company is generating more revenue with less capital.

Cash Flow

Finally, a company’s how to calculate burn rate burn rate can affect its market position and competitive advantage. A high burn rate may signal that a company is investing aggressively to expand, develop new products or services, or capture market share. A low burn rate, on the other hand, might indicate a conservative approach to growth. Thus, understanding burn rate can provide insights into a company’s strategic direction and competitive landscape. A high gross burn rate may indicate that a company is inefficient with its resource allocation. However, it’s worth noting that some industries have inherently high operating costs and may require a higher burn rate for growth.

How to Calculate Burn Rate in Excel: Step-by-Step Guide for Beginners

- To maintain operations and expansion, businesses may also turn to additional rounds of venture capital funding or potentially an initial public offering (IPO).

- Burn multiples above 3x may indicate issues with cost control, gross margins, sales efficiency, or customer churn.

- Thus, understanding burn rate can provide insights into a company’s strategic direction and competitive landscape.

- The unit economics is calculated as the contribution margin, which is the difference between the selling price per unit and the variable costs per unit.

- See what cutting the marketing budget and changing tactics does for a month or two.

- Since gross burn is just monthly operational costs, the formula is simply adding up all expenses together.

A most basic analysis of the net burn rate tells you whether your business is self-sustaining or not. If the net burn rate is positive, then you’re spending more money than you’re taking in, and something needs to change. The burn rate tells companies how much money they’re spending and how quickly they’re spending it. The term is usually used in the context of a new company that’s trying to ramp up its operations and become profitable.

SaaS startup example

It takes into account not only your operating expenses but also other cash outlays such as loan payments and owner’s draws. Identifying and reducing costs is one way for a business to improve its burn rate. By proactively identifying areas of wasteful spending and taking steps to reduce them, a small business can free up more of its funds for other investments, such as marketing and growth initiatives.

What is Cash Flow Management? Definition, Strategies, and Examples

- If each dollar invested generates $5 in profits, spending more aggressively will help capture more market share, even if it delays profitability.

- Given the amount of funding raised in the previous round, the $10mm, running out of cash in one year is considered fast.

- When a company experiences a high burn rate, it typically exhausts its funding at a faster pace than anticipated.

- It’s often calculated by month (e.g., a startup with a burn rate of $30,000 a month is spending $30,000 a month) and is spent on both overhead and variable expenses.

- These are just a few examples that can affect your business’s profitability.

Learn how Novo can help you stay on top of your company’s burn rate with a free business checking account designed just for small business owners. Small businesses can increase revenue by focusing on their most profitable products or services, pricing their offerings competitively, and building relationships with customers. Increasing revenue can help improve a company’s burn rate by bringing in more money that can fund new products, pay for additional staff, and fuel growth initiatives. Burn rate is important for any small business owner to understand, as it measures how quickly a business is spending capital. If you’re a small business owner unfamiliar with the concept of burn rate and its implications, get our guide on how to assess this metric to help make informed business decisions.

Early-Stage Startup Operating Assumptions

- Pausing or slowing down new hires can prevent the burn rate from increasing further as the company scales – or if an economic downturn occurs.

- Net burn rate is useful if you want to measure profit growth since it shows how much you’ve earned versus how much you’ve spent.

- By closely monitoring expenses and focusing on revenue generation, businesses can effectively manage their burn rate and ensure sustained growth and success.

- In this guide, we’ll go over burn rate, why it’s important for entrepreneurs and investors, and how to increase revenue without increasing expenses.

- Here are some general principles to help you better understand the concept – including what a good burn rate looks like.

- The PMF is the sweet spot where a company’s product effectively meets the needs of its target market, resulting in strong customer adoption, satisfaction, and growth potential.

A company’s burn rate is also used as https://www.bookstime.com/articles/accounting-for-architects a measuring stick for what’s referred to as its “runway,” the amount of time the company has before it runs out of money. At the maturity stage, companies usually have a well-established and stable customer base, operational infrastructure, and strategic direction. The focus of businesses in this phase is achieving a self-sustaining and potentially profitable state.

Posted in Bookkeeping | Comments Off on Burn Rate Calculator: Calculate Your Monthly Burn & Runway